Posted in: Trading Bot

What Is a Crypto Sniper Bot? Key Features & How To Use

Imagine missing out on a 10× token launch because you were even a second too slow—frustrating, right? That happened to me on my first attempt at sniping a Solana token: I clicked “buy” manually, but by the time my transaction confirmed, the price had already shot up. That’s when I discovered the power of a crypto sniper bot. In this post, you’ll learn exactly what a sniper bot is, explore its key features, and see how to use one step‑by‑step, including a free Download at Sniper Bot page

What Is a Crypto Sniper Bot?

A crypto sniper bot is specialized software that automatically spots new token listings on blockchains like Solana, BSC, or Ethereum—and executes buy orders within the same or next block. It gives you a speed advantage in volatile markets where every millisecond counts.

-Why Traders Use Sniper Bots

How Does a Sniper Bot Work?

At its core, a sniper bot connects to blockchain nodes, listens for token‑listing events, and auto‑submits transactions when your predefined conditions are met—no clicks required.

-Order Placement & Timing

-Automatic vs. Manual Sniping

– Automatic: You define triggers (price, volume thresholds) and let the bot handle execution. Anecdote: On my second try, I let the bot run overnight—and woke up to a 4× gain before breakfast.

Top Features of an Effective Sniper Bot

Not all bots are created equal. To choose wisely, look for features that maximize speed, reliability, and security.

-Fast Transaction Speed

-Slippage Control & Gas Optimization

-Multi‑Chain & Custom Node Support

-Security & Wallet Integration

Real‑World Use Cases

See sniper bots in action, from token launches to arbitrage strategies that capture Miner Extractable Value (MEV).

-New Token Launch Sniping

-Arbitrage & MEV Strategies

Pros & Cons of Using a Sniper Bot

Before you dive in, weigh the benefits against potential pitfalls.

-Advantages

-Risks

How to Get Started & Free Trial Offer

1. Visit our Sniper Bot page.

2. Start Your Free Download

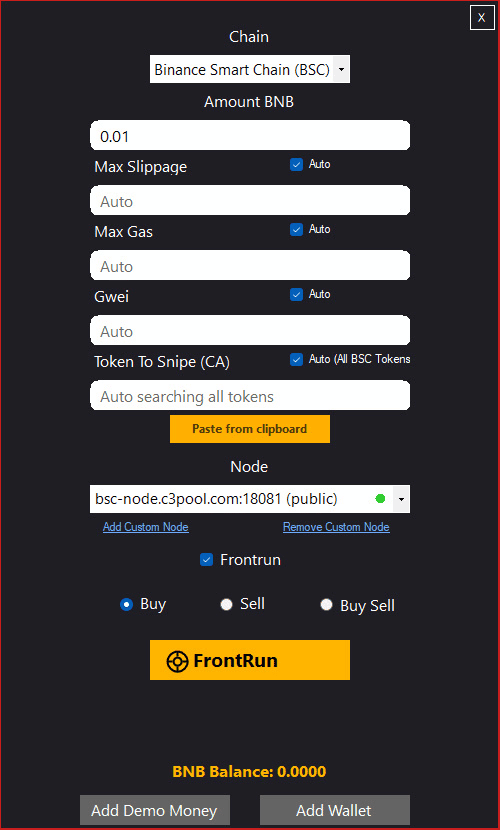

3. Select Your Chain.

4. .Add demo funds in safe mode

5. C Configure slippage and gas settings

6. Click “Snipe” and watch the bot work for you—For up‑to‑date token listings, APIs like CoinGecko API can be invaluable.

Frequently Asked Questions

What blockchains does the sniper bot support?

How do I control slippage and gas fees?

Can I lose money when sniping tokens?

Can i add real wallet in Free mode

How Can I start Adding Demo Funds?

Conclusion

Crypto sniper bots aren’t just for advanced traders anymore—they’re the new standard for anyone who wants a serious edge in volatile markets. Whether you’re tracking meme coins, launching your own token, or just tired of missing early entries, the speed and automation a sniper bot gives you can make all the difference. I’ve personally missed golden chances before using one—and that’s why I now let the bot do the heavy lifting. If you’re ready to level up your strategy, reduce emotional decision‑making, and take control of your entries, head over to our official Sniper Bot page. You can try it out with demo funds in safe mode—no wallet risk, no commitment. It’s built for Solana, supports volume bots and pump.fun bundlers, and is constantly being updated by experienced blockchain developers. Your advantage starts now—test it for free and see why more traders are automating their success with us.