Posted in: Trading Bot

Multi-Chain Pancakeswap & Uniswap Sniper Bot

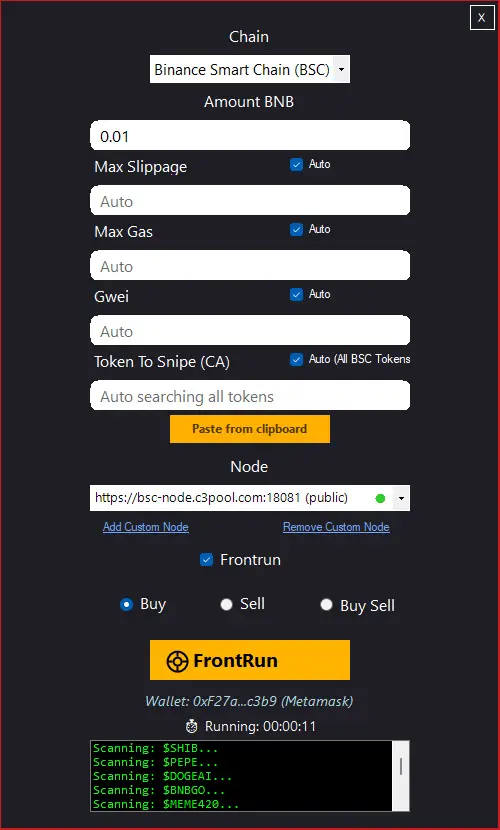

This multi-chain sniper bot on supports Pancakeswap on https://decryptor.net/sniper-bot/ BSC and Uniswap on Ethereum, combining advanced mempool monitoring, DEX screening and same-block execution to help you act faster on token listings. Built for traders who want integrated charts, Gwei tracking for ETH, honeypot checks and a live profit tracker to evaluate trades and refine strategy.

How the sniper bot works: a quick overview

The sniper bot automates discovery and execution on decentralized exchanges – screening tokens, monitoring mempool activity, and placing trades when your filters trigger. Designed for Pancakeswap and Uniswap markets, the bot lets traders move faster than manual trading by combining a DEX screener with on-chain execution logic.

Supported chains and DEXs (BSC & ETH focus)

This tool targets Pancakeswap on BSC and Uniswap on Ethereum, with architecture built around the differences between BSC and ETH networks. That means fee tracking, gas (Gwei) monitoring for ETH trades, and swap-fee awareness for BSC swaps are all tuned to each chain’s characteristics.

Why BSC and ETH matter for sniping

BSC tokens often list with low fees and fast blocks, which changes timing and slippage expectations compared with ETH. The bot’s BSC sniper bot features optimize for chain-specific constraints while the ETH side adds Gwei tracking to help with same-block execution on Uniswap.

Core features that make the bot effective

The bot bundles discovery, execution, and risk checks so you can focus on strategy rather than manual order placement. Key feature groups below explain how discovery, execution and protection work together.

Execution & mempool capabilities

Mempool monitoring, same-block multi-buy and multi-sell transactions, and first-block execution logic allow fast entries at liquidity additions or triggered events. These features are the backbone of a true sniper workflow on Pancakeswap and Uniswap

Risk controls, safety and testing

Good sniper bots include protective checks – honeypot detection, rug indicators, and the option to test strategies in a sandbox or demo environment. Always validate filters and execution logic with test runs before deploying significant capital on either BSC or ETH.

How to validate performance without risking funds

Run the bot in test mode, gather long-sample metrics (win rate, average payout, variance), and tune your filters. Use the integrated profit tracker and charts to compare predicted vs actual results and refine your approach.

Performance expectations & measuring success

Expect variability: a bot can find early opportunities but won’t guarantee consistent 100x hits. Measure success through repeatable metrics: consistent edge vs baseline, ROI over many trades, and reliability of same-block execution when liquidity events occur.

Best practices and responsible usage

>Use conservative position sizing, cap exposure per trade, and incorporate stop-loss or auto-sell rules. Respect DEX terms and community norms, keep awareness of gas and fee mechanics on ETH vs BSC, and combine the bot’s signals with a clear crash/trade strategy rather than relying on it alone.

How to Get Started & Free Trial Offer

1. Visit our Sniper bot page.

2. Start Your Free Download

3. Open GUI.

4. Add demo money for test

5. start sniping with demo money, risk free

6. choose block chain to target first

7. leave most of things on auto for optimal optimization

8. snipe your first ever fastest token sniper.

Frequently Asked Questions

Does this support Pancakeswap and Uniswap?

Is the bot free to use?

What is “same-block” execution?

Will the bot bypass anti-bot measures?

Can I test strategies before trading live?

What chains are planned beyond BSC and ETH?

How do fees work on BSC vs ETH?

Is presale sniping supported?

Conclusion

The All-In-One Pancakeswap & Uniswap sniper bot brings powerful discovery and execution tools to traders on BSC and ETH – mempool monitoring, DEX screening, same-block execution and built-in risk checks can speed up entries and streamline a data-driven crash/trade strategy. That said, a sniper bot is a tool, not a guarantee: treat it as one input to a disciplined plan that includes position sizing, stop-loss rules and thorough backtesting.

Avoid trusting bold promises about guaranteed wins or methods that claim to circumvent protections; focus instead on transparent features (honeypot checks, profit tracking, Gwei awareness on ETH) and measurable results. Always validate filters and execution logic in a test environment, track long-sample metrics, and tune settings for the differences between BSC and ETH before committing real capital.

Finally, keep an eye on development and community support: the best sniper projects evolve with new safeguards, clearer fee models, and better analytics. Use the bot to find and act on opportunities, but prioritize safety, reproducibility, and responsible trading over hype.